Does your business need to offer shared credit limits?

Normally, customers spending a lot of money on your business is a good thing. But when there are multiple buyers or accounts for a single client, things can get a little complicated.

Lots of individual purchases coming from different parts of the organization can become difficult to track, which could easily lead to awkward conversations with the customer’s finance department about overspending (and good luck resolving the balance in a timely manner).

If that situation sounds familiar to you, then you’d probably benefit from implementing a shared credit limit to your company associations.

What is a shared credit limit?

A shared credit limit is a cap on spending that applies to all buyers in an organization. Everyone has the same overall limit.

For example, if a customer has a $100,000 annual limit, and Sharon from Store A orders $5,000 worth of supplies, then all of the other stores in the organization still have $95,000 available for their use.

Why does a shared credit limit matter for business buyers?

Traditionally, companies would have to either assign separate credit limits to each individual buyer or rely on informal expense tracking and accounting oversight—if they did that at all.

A shared credit limit allows both suppliers and companies to better balance individual spending with budget control and financial visibility without adding undue administrative burden.

Shared credit limits are especially beneficial for:

- Wholesale buyers. Companies that buy in bulk with multiple purchasing agents can consolidate credit and make it easier to manage large order volumes.

- Organizations with centralized budget control. Shared credit structures will be invaluable for finance teams or budget managers responsible for overseeing multiple buyers.

- Growing companies with expanding purchasing teams. As businesses grow, so do their purchasing needs. A shared credit limit helps scale credit control to keep up with business growth.

Key benefits of shared credit limits

Setting your customers up with a shared credit limit can give you both tremendous benefits.

- Simplified credit tracking. Instead of juggling separate credit limits for each account, businesses will be able to track spending against a singe limit, thus giving a much clearer overview of the company’s total outstanding balance.

- Streamlined purchase process. With a shared credit limit in place, employees don’t have to worry about tracking individual credit limit. They can place orders confidently, knowing that all purchases will fall under the company’s overall budget (although they will still have to exercise restraint).

- Improved budget control. By consolidating all credit resources under a single limit, leaders can better see how each department’s or location’s spending will affect everyone else’s. This helps them set more accurate spending thresholds for each entity.

Special considerations

As you can see, shared credit limits can apply to a number of different scenarios and can be flexibly applied. For best results, however, you need to keep a few things in mind:

- A credit limit is not a hard cap. A credit limit exists to help companies control their costs, but it shouldn’t prevent them from buying more to cover urgent needs. Make sure your customers know that you’re willing to be flexible, whether it’s overriding the limit every once in a while (with written approval) or renegotiating it entirely. Ultimately, it’s the customer who decides how much they want to spend.

- Buyer-specific credit limits. Although the shared credit limit applies to all associated buyers by default, certain ecommerce systems like our B2B Commerce Platform will accommodate unique purchasing needs by letting you set limits at the individual account level. You can set a credit limit that applies only to one buyer, and won’t count towards the company limit.

- Hitting the credit limit prevents additional orders. We don’t allow customers to place additional orders with custom payment methods once their order balance is over the credit limit. This is a safeguard to prevent going over budget, and the customer should immediately reach out to your team for a resolution.

Admins can give the customer the ability to see their credit limit by applying the following merge code: ##CUSTOMERCREDITLIMIT##

How to apply shared credit limits in the B2B Portal

Setting up shared credit limits on our platform is easy and straightforward.

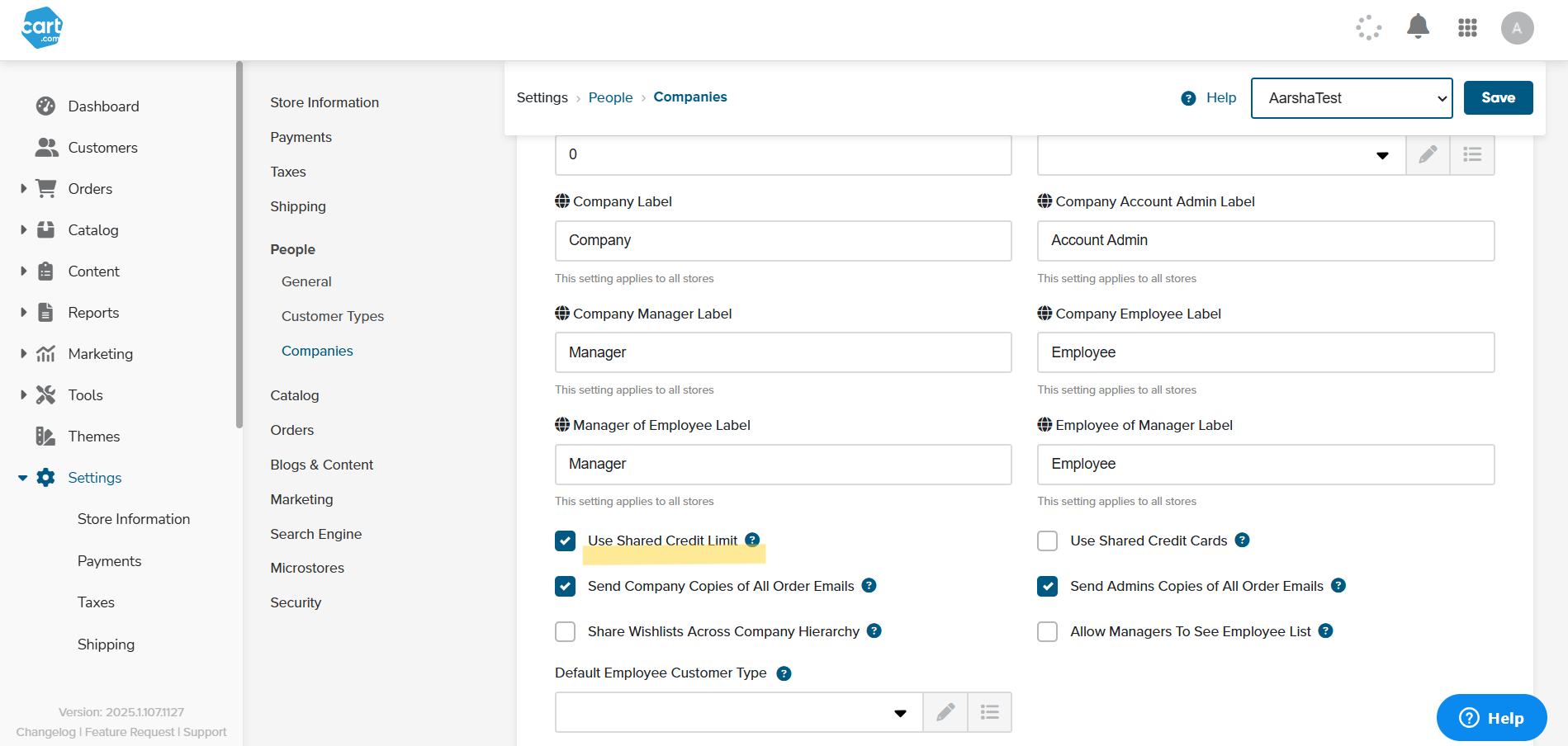

The first thing you need to do is go to your admin dashboard. Go to Settings > People > Companies and activate the Shared Credit Limit checkbox.

This will apply the shared credit limit to all of the company’s associated accounts.

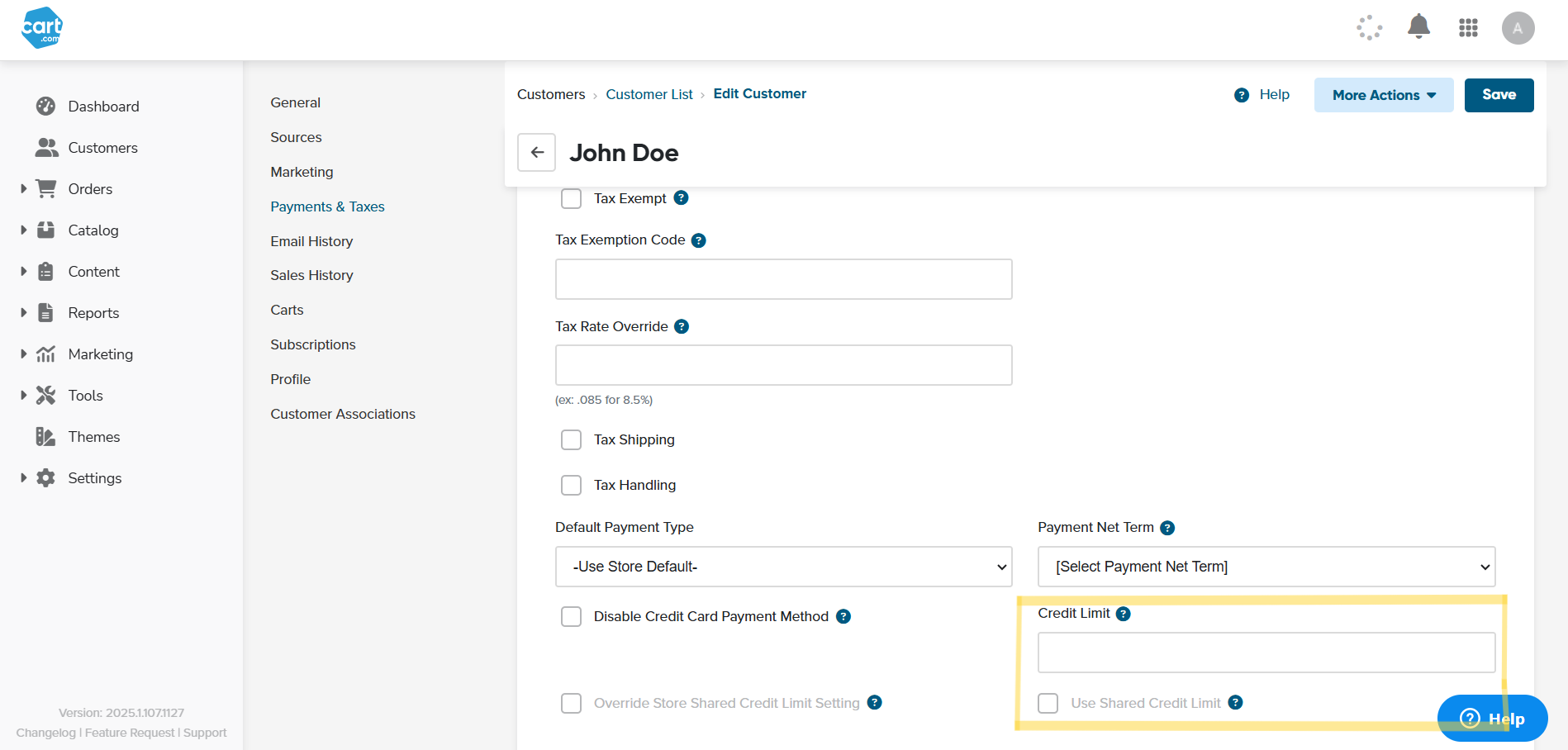

To set the actual credit limit amount for a specific customer, go to Customers > Customer List > Edit Customer > Payment & Taxes and edit the Credit Limit field.

Once that’s set up, your customer and their employees will be able to order equipment and supplies in full confidence, not having to worry about accidentally going over budget.

Want to know more about how you and your customers can benefit from shared credit limits within our platform? Contact us and we will have an experienced ecommerce specialist walk you through the process.